What We Were Reading and Watching this Week

Enjoy, look forward to hearing any feedback, questions, and comments!

Economy

Mortgage rates are now at 7.09% per Freddie Mac’s weekly release.

This is less than a percentage point off its late 2023 peak of 7.79%, and about where they were back in 2004.

Source: Macrotrends Shaded areas represent recessions

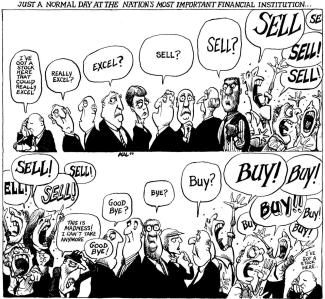

Markets

Treasuries are cheap, compared to stocks on an earnings yield basis.

Treasury notes and bonds look attractive, as inflation eases, and a possible slow down in the economy increases their appeal.

10-year note yields have dropped 1.5 percentage points on average in the last eight recessions.

TECHNICAL UPDATE

Stock Market

The S&P 500 closed higher this week as investors embrace the idea that economic "bad news is good news” , with the market focused on rate cuts once again.

Week:

YTD : 9.82%

Market technicals are once again mixed, with no downside distribution, and selling into up markets, still in place.

There are no changes in our net invested position within our model portfolios.

Please schedule a call with any questions regarding our Core & Protect risk management process, our research, and our model portfolios.

https://calendly.com/jstanton-1/stanton-group-introduction-with-john-stanton

Bond Market

10 Year Treasury Yield 4.52%

Gold

Gold remains an inflation risk hedge, and a hedge against geopolitical uncertainties.

Price is up 15% from January 1 2024, up 17% over past 12 months.

Source: Y Charts

Agriculture & Health

White Paper "Soil Health on Organic Farms" reviews the importance of improving soil health on our nations farms.

https://iroquoisvalley.com/impact/organic-system/

John is the founder of The Stanton Group WP. With more than three decades of experience in the financial services industry, and through SeaCrest Wealth Management, LLC, serves as the Registered Investment Advisor Representative for clients, focusing on financial planning and the investment strategies to support their financial plan.

Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the Chicagoland area.

Learn more about John’s services by visiting www.stantongwp.com

John can be reached at l 630-445-2380 or email JStanton@seacrestwm.com.

The Stanton Group WP provides investment advisory services through SeaCrest Wealth Management LLC, (the “SWM”) a registered investment advisor. SWM is a registered investment advisor (“RIA”), with the U.S. Securities and Exchange Commission located in the State of New York. SeaCrest Wealth Management, LLC can be reached at (914) 502-1900.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of John Stanton, and should not be regarded as the views of SeaCrest Wealth Management, LLC, or its respective affiliates or as a description of advisory services provided by SeaCrest Wealth Management, LLC, or performance returns of any SeaCrest Wealth Management client.

The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned.

Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.