The Traditional 60/40 Portfolio: Why This Did Not Work in 2022

From our January Client Note

The Traditional 60/40 Portfolio: Why This Did Not Work in 2022

60-%-40%, is the widely held belief by the investment community, that an investment portfolio should hold 60% stocks and 40% bonds.

60%-40% was simple, and supposedly stable. Investors who lacked the skill, and/or time to analyze more complicated and usually riskier investment strategies, could follow this simple rule.

Since many other individual and institutional investors followed the same strategy, this creates a feeling of peace of mind, safety in numbers, but also sets the stage for huge disappointment and losses when it suddenly failed in 2022.

The way the strategy is supposed to work, when stocks are in a bear market, like we are at present, ultra safe Treasury bonds will serve to cushion the fall of the total portfolio’s value. But, with the rapid increase in interest rates, both Fed and market induced, bonds are now in their first bear market since 1994. he justification for 60%-40%, of course, was that when stocks are in a bear market, as at present, ultra-safe Treasury bonds will serve as a safe haven and cushion the fall in the total portfolio’s value. But with bonds now in their first bear market in decades, a portfolio of 60% in the S&P 500 index and 40% in 10-year Treasury notes has

No Place To Hide

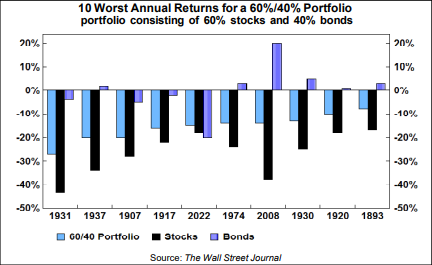

2022 was not the only year the 60/40 portfolio failed. In 1937, 1974, 1930, 1920 and 1893, 60%-40% portfolios fell but 10-year Treasury note returns offset some of the declines in stocks. And in 1931,1907 and 1917, small losses in Treasurys offset some of the big drops in equity prices. Investor strategies made this year’s losses in 60%-40% portfolios especially painful because few consider any other investments besides long stocks and long bonds. In equity bear markets associated with recessions, there are no sectors in which stock investors can hide. All sectors suffer equally in bad times, including the so-called defensive sectors, things that people buy in good times and bad.

Places that Thrived

There are, however, were places to not only hide in the ongoing equity bear market but also make money. As our strategy update readers will recall, starting in January 2022, we recommended raising cash, selling growth stocks, initiating a small short position in the S&P 500, as a hedge to a core position of equities in productive, well managed, businesses.

Our fixed income strategies were focused on maturing bonds/CDs/treasuries in a maturity ladder, and were positioned for increasing interest rates, to cool the inflation. As rates increased across the yield curve, maturing positions were redeployed to higher yielding bonds/CDs/treasuries, in our portfolios. And, based on the increasing weight of evidence, recession was anticipated towards year end, beginning of 2023.

General real estate that relied on mortgage financing was going to cause a slowdown of demand in a very hot, at the time, residential real estate market. Conservatively managed select commercial real estate, particularly in the logistics, digital warehouse, and agricultural space, did well for 2022.

For the complete client review, review our process, introduce the investment team, and how our strategies are positioned going into the New Year, schedule a call with our founder, John Stanton.

https://calendly.com/jstanton-1/investment-strategy-call

John is the founder of The Stanton Group WP. With more than three decades of experience in the financial services industry, he serves as an advisor for clients, focusing on financial planning the investment research and strategies to support their financial plan. Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the Chicagoland area.

The Stanton Group WP provides investment advisory services through SeaCrest Wealth Management LLC, (the “Advisor”) a Registered Investment Advisor. Information in this message is for the intended recipient[s] only. Please visit our website www.stantongwp.com for important disclosures.

SeaCrest Wealth Management, LLC (CRD 147092) is a Registered Investment Advisor with the U.S. Securities and Exchange Commission, headquartered at 3010 Westchester Avenue Purchase, NY 10577.

Past performance is no guarantee of future results.

This information contained is the property of The Stanton Group WP (SGWP) and we provide it for information and educational purposes only. Since we cannot anticipate all the requisites of each individual recipient, there is no consideration given for the specific investment needs, objectives or tolerances of any of the recipients. Additionally, SGWP’s actual investment positions may, and often will, vary from the conclusions discussed herein based upon any number of factors, such as client or potential client investment restrictions, portfolio rebalancing and transaction costs, among others. Reasonable people may disagree about a variety of factors discussed in this document, including, but not limited to, key macroeconomic factors, the types of investments expected to perform well during periods in which certain key economic factors are dominant, risk factors and various assumptions used. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy any securities or instruments, whether mentioned or not. No part of this document or its subject matter may be reproduced, disseminated, or disclosed without the prior written approval of The Stanton Group WP.

FORWARD LOOKING STATEMENTS AND OPINION: Certain statements contained in this presentation may be forward-looking statements that, by their nature, involve a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially, potentially in an adverse manner, from those expressed or implied herein. Forward-looking statements contained in this presentation that reference past trends or activities should not be taken as a representation that such trends or activities will necessarily continue in the future. SGWP undertakes no obligation to update or revise any forward—looking statements, whether as a result of new information, future events or otherwise. Opinions offered herein constitute the judgment of SGWP, as of the date of this presentation, and are subject to change. You should not place undue reliance on forward-looking statements or opinions, as each is based on assumptions, all of which are difficult to predict and many of which are beyond the control of SGWP. SGWP believes that the information provided herein is reliable; however, we do not warrant its accuracy or completeness. The information contained in this document is current as of the date shown. Additional information regarding the analysis shown is available upon request, except where the proprietary nature precludes such dissemination. Information presented herein (including market data and statistical information) has been obtained from various sources which SGWP considers to be reliable. However, we make no representation as to, and accept no responsibility or liability whatsoever for, the accuracy or completeness of such information. All projections, valuations and statistical analyses are provided to assist the recipient in the evaluation of the matters described herein. This material is not intended to represent a comprehensive overview of any law, rule or regulation and does not constitute investment, legal, or tax advice. You should exercise discretion before relying on the statements and information contained herein because such statements and information do not take into consideration the particular circumstances or needs of any specific client or potential client. Accordingly, SGWP shall have no liability, whatsoever arising to the maximum extent permitted by law, for any loss or damage, direct or indirect, arising from the use of this information by you or any third party relying on this information.