Our Investment Philosophy: Core & Protect

Risk-First, Evidence-Driven, Sleep-at-Night Investing

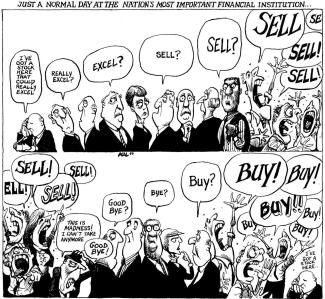

In a world that celebrates the cult of “buy and hold” on one side and aggressive market-timing on the other, we take a different path. We believe the primary job of a portfolio manager is not to predict the future, but to respect risk.

Markets are not always investable. Sometimes they offer generous compensation for bearing equity risk; other times they offer almost none—or worse, they punish those who stay fully invested. History is unambiguous on this point: the greatest losses (and the greatest emotional scars) come from being fully exposed to equities during periods of elevated risk.

That is why the foundation of everything we do is a disciplined, repeatable assessment of market risk—before we ever think about picking a single share of company stock.

Our objective is straightforward: deliver long-term returns that meet or exceed the historical average of the stock market while experiencing significantly less volatility and dramatically smaller drawdowns. In other words, we want our clients to participate meaningfully when conditions are favorable and to protect capital when they are not—creating what we call the “Sleep-at-Night” factor.

This is not about hugging an index or chasing the hottest trend. It is active risk management grounded in objectivity and discipline.

Core and Protect: Our Three-Step Process

Every portfolio we build follows the same rigorous three-step framework:

1. Assess the Risk Environment (Top-Down)

We begin by asking one overriding question: “Does the weight of the evidence suggest the equity market is in a low-risk, wealth-creating phase of the cycle, or a high-risk, wealth-destroying phase?”

To answer it, we examine a broad dashboard of macroeconomic and technical indicators that have historically done the best job of identifying where we are in the business and market cycle—things like yield-curve shape, credit spreads, unemployment trends, inflation signals, trend-following measures, breadth, and sentiment.

No single indicator is perfect, but the convergence (or divergence) of many tells us a great deal.

2. Determine Strategic Equity Exposure

Based on that weight of evidence, our process leans into the market, or leans away from the market. We call this our Net Invested Position.

When the evidence is strongly favorable → 90–100% net long

When the evidence is neutral → 50–80% net long

When the evidence is unfavorable → 0–40% net long (or even temporarily net short via low-cost inverse index funds)

This is the single most powerful risk-management tool we have. Reducing equity exposure during dangerous periods has historically been far more effective at preserving capital than any amount of individual stock picking.

3. Select Individual Securities (Bottom-Up)

Only after the risk budget is set do we turn to fundamental analysis. Within the allowed equity sleeve, we overweight high-conviction ideas—companies with strong balance sheets, durable competitive advantages, attractive valuations, and positive earnings revisions, along with market, sector stock ETFs. When equity exposure is low, the remaining capital is held in short-term Treasuries, T-bills, or gold—assets that tend to perform well when risk aversion rises.

This Is Not Market Timing—It Is leaning into the market, and leaning away from the market, as the technical evidence guides .

Risk Management

You will sometimes hear critics dismiss any deviation from 100% equity as “market timing.” We reject that label. Market timing implies frequent trading based on subjective forecasts and a desire to be fully in or fully out at the perfect moment. What we do is the opposite: we follow a systematic, rules-based process that is deliberately slow-moving and humble about its abilities. We are not trying to catch every twist and turn. We are trying to avoid being fully invested during the small number of periods (typically 18–36 months every decade) when the market can cut your capital in half. History shows that avoiding the worst drawdowns is the most reliable path to compounding wealth over decades.

The Tools in Our Arsenal

Trend and momentum measures (e.g., 10–12 month moving averages)

Macroeconomic overlays (leading economic indicators, ISM surveys, credit spreads)

Market breadth and participation statistics

Valuation extremes relative to interest rates

Low-cost inverse non leveraged index ETFs (used sparingly and only as a hedge)

When multiple signals align, we act. When they conflict, we stay patient. The Result: Smoother Ride , with the ability to lean into the market with dry powder (Cash), when the weight of evidence turns.

Protection when it matters most. And the ability to sleep at night—every night—for decades. That is the promise—and the daily practice—of our risk-managed, evidence-driven philosophy.

We look forward to sharing how this could work for your financial game plan!

Let's Start a Conversation

Have questions? Ready to take the next step? We are here to help. Whether you’re looking for advice or want to learn more about our services, schedule a call with us today.

Schedule a Call With Stanton Group Wealth

John Stanton

For over 20 years, John and his team have been helping successful individuals and their families, plan, preserve, protect, and pass on their hard earned wealth.

Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the United States.

Learn more about John's services by visiting https://www.stantongwp.com/team-member-01 or connecting with him on LinkedIn https://www.linkedin.com/in/john-stanton/ .