What We Were Reading & Watching this Week

John Stanton

Welcome to our new weekly summary, of what we have been reading, watching, and commenting on throughout the week in our practice.

Enjoy, and look forward to any feedback, questions and comments!

Economy

The Consumer Price Index Comes in Hot, Rose .4% in March

ISMs Show Improvement

This week, the Institute for Supply Management (ISM) released their Purchasing Managers Index for both Services and Manufacturing for the month of March. The Services Sector missed expectations and fell slightly but remains above contraction territory (<50.0) at 51.4. The most recent report indicated that the Index is still growing, but at a slower rate. The New Orders component also grew at a slower pace in March, seeing a decrease to 54.4.

https://ycharts.com/indicators/us_ism_non_manufacturing_index

https://ycharts.com/indicators/us_pmi

Markets

TECHNICAL UPDATE

Leadership continues to be mixed. We continue to maintain a neutral stance regarding portfolio positioning, based on the current evidence.

Please schedule a call with any questions regarding our net long positioning within our model portfolios.

Gold continued its rapid rise this week to new highs, due to its status as a safe haven, to protect against returning inflation pressures, and increased geopolitical tensions.

Interest rates rose, from 4.39% , to 4.56%, on the 10 year treasury, as of the close on Thursday.

The S&P 500 is on track to close lower for the week, from 5204 last Friday, and 5254 the end of March.

Please schedule a call with any questions regarding our net long positioning within our model portfolios, portfolio strategy, or questions regarding the above.

https://calendly.com/jstanton-1/stanton-group-introduction-with-john-stanton

Health, Wealth, and Agriculture

Community Supported Agriculture

For over 25 years, Community Supported Agriculture (CSA) has become a popular way for consumers to buy local, seasonal food directly from a farmer.

https://www.localharvest.org/csa/

Regenerative Agriculture

Farmer Joel Salatin discusses the solutions to make farming provide more food at a higher nutritional density.

https://www.youtube.com/watch?v=GLoTfR73rIE

Farm Stories

Learning about the farmers and their families that are making it happen in the regenerative and organic agriculture space.

https://iroquoisvalley.com/farms/farm-stories/

Leisure Reading

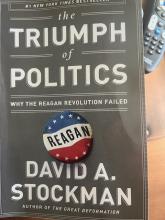

I have some time to catch up on my leisure reading this week, visiting my oldest son A.J. in Arizona.

Written by David A Stockman, who served as White House budget director within the Reagan administration, this is a fascinating take on the Reagan Revolution, and why it failed, from his perspective.

John is the founder of The Stanton Group WP. With more than three decades of experience in the financial services industry, he serves as an advisor for clients, focusing on financial planning and the investment strategies to support their financial plan. Based in Naperville, Illinois, John serves clients in Naperville, Plainfield, Darien, Aurora, Geneva, St Charles, and throughout the Chicagoland area.

Learn more about John’s services by visiting www.stantongwp.com

John can be reached at l 630-445-2380 or email JStanton@seacrestwm.com.

The Stanton Group WP provides investment advisory services through SeaCrest Wealth Management LLC, (the “SWM”) a registered investment advisor. SWM is a registered investment advisor (“RIA”), with the U.S. Securities and Exchange Commission located in the State of New York. SeaCrest Wealth Management, LLC can be reached at (914) 502-1900.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The views reflected in the commentary are subject to change at any time without notice.

Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. It also should not be construed as an offer soliciting the purchase or sale of any security mentioned.

Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Any indices referenced for comparison are unmanaged and cannot be invested into directly. As always please remember investing involves risk and possible loss of principal capital; please seek advice from a licensed professional. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.